Taxation in Ontario Guide for Incorporated Businesses

Taxation in Ontario refers to the mandatory financial contributions levied by the provincial and federal governments on individuals and businesses within the province. This revenue is crucial for funding public services and infrastructure like healthcare, education, and transportation in the province.

Taxation in Ontario is a dual system, meaning residents and businesses pay both federal taxes (collected by the Canada Revenue Agency or CRA) and provincial taxes.

Key Types of Taxation in Ontario

The primary forms of Taxation in Ontario include:

- Personal Income Tax: Ontario operates a progressive income tax system, where higher income is taxed at higher rates. Individuals pay this provincial tax in addition to the federal income tax. The Canada Revenue Agency (CRA) administers both the federal and Ontario personal income tax.

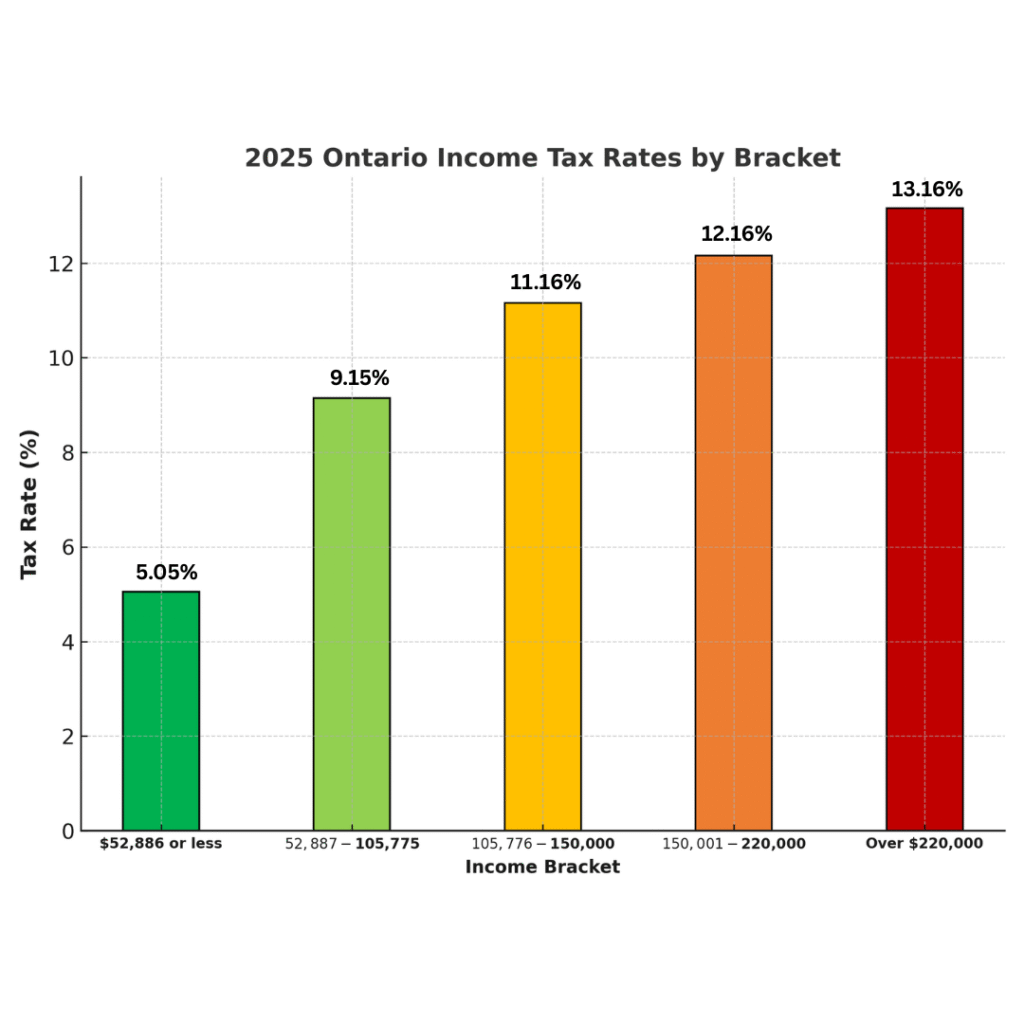

- Ontario Tax Rates (as of 2025 rates provided): Ranging from 5.05% on the lowest bracket of taxable income (up to approximately $52,886) to 13.16% on taxable income over approximately $220,000.

- Consumption Tax (Harmonized Sales Tax – HST): This is a single, combined sales tax of 13% on most goods and services, which includes the 5% federal Goods and Services Tax (GST) and an 8% provincial component.

- Corporate Tax: Businesses operating in Ontario are subject to a provincial corporate tax, which is applied in addition to the federal corporate tax. The general corporate tax rate is typically 11.5%, though lower rates may apply to small businesses or those in specific sectors like manufacturing and processing.

- Property Tax: This is a key tax levied by municipalities (not the provincial government) and is based on the assessed value of real estate. Rates vary significantly depending on the local municipality.

- Other Provincial Taxes: The Ontario government also collects other taxes, such as the Land Transfer Tax (on property purchases), the Employer Health Tax (EHT), and the Ontario Health Premium for higher-income individuals.

Related: Best Canadian Provinces To Start A Business As A Foreigner

Ontario tax filing deadline

The Ontario personal tax return is filed with your federal tax return to the Canada Revenue Agency (CRA), so the deadlines are the same across Canada.

For most individuals filing their 2024 tax return (tax season 2025), tax deadlines are:

| Tax Payer Status | Filing Deadline | Payment Deadline |

| Most Individuals | April 30, 2025 | April 30, 2025 |

| Self-Employed (or spouse/common-law partner is self employed) | June 16, 2025 (Since 15 June, is a Sunday) | April 30, 2025 |

Payment is due for everyone by April 30, 2025 regardless of the filing deadline. If you’re self-employed and owe tax, you must still pay by April 30 to avoid interest.

The deadlines refer to the max return for the 2024 tax year.

When Is Canadian Tax Filing Deadline – Thu, Apr 30, 2026

Calculating your income tax in Ontario involves combining both the federal and provincial tax systems, as both levels of government levy income tax. The total tax payable is the sum of these two separate calculations, after applying relevant tax credits. This is the general process for taxation in Ontario.

Steps to Calculate Income Tax

The calculation follows these main steps:

Determine Total Income and Net Income

Calculate your Total Income (all income sources like employment, investments, pensions, etc.). Subtract allowable Deductions (like Registered Retirement Savings Plan (RRSP) contributions or union dues) from your total income to arrive at your net income.

Determine Taxable Income

Subtract further deductions (like the non-refundable portion of a capital gains deduction) from your net income to determine your Taxable income. This is the figure on which your tax will be calculated.

Calculate Federal Tax

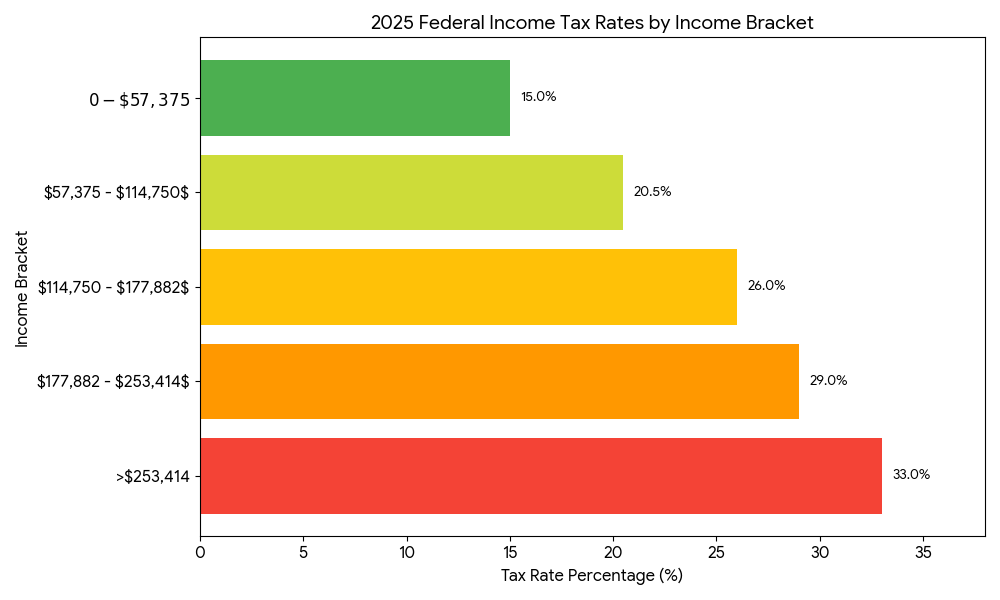

Apply the Federal Income Tax Rates (tax brackets) to your taxable income. Canada uses a progressive tax system, meaning higher income portions are taxed at higher rates.

Subtract your applicable Federal Non-Refundable Tax Credits (such as the Basic Personal Account (BPA) and dependents’ credits). These credits reduce the amount of tax owed, not your taxable income.

Calculate Provincial Tax (Taxation in Ontario)

Apply the Ontario Provincial Income Tax Rates (tax brackets) to your Taxable income. Ontario also uses a progressive system.

Subtract your applicable Ontario Non-Refundable Tax Credits (such as the Provincial BPA).

Note: You may also be subject to the Ontario Health Premium, which is a separate levy based on Taxable Income, and the Ontario Tax Reduction for lower-income individuals. This is part of the overall taxation in Ontario system.

Determine Total Tax Payable

- Add the Federal Tax (from step 3) and the Provincial Tax (from step 4) to find your total gross tax.

- Subtract any Refundable Tax Credits (like the Ontario Trillium Benefit or credits for taxes paid on investment income) and any taxes already withheld from your paychecks (as shown on your T4 slip).

The result is your final Total Tax Payable (or refund if the result is negative). This complex interaction is central to taxation in Ontario.

Example Calculation (Illustrative Rates)

This simplified example for taxation in Ontario assumes a single taxpayer with a Taxable Income of $60,000 for the 2025 tax year, claiming only the basic personal tax credits.

| Calculation Step | Calculation | Tax Due/Credit |

| Federal Tax | ||

| 1. Tax on first $57,375 at 14.5% | $57,375×0.145 | $8,319.38 |

| 2. Tax on remaining $2,625 at 20.5% | ($60,000−$57,375)×0.205 | $538.13 |

| Total Gross Federal Tax | $8,857.51 | |

| 3. Less: Basic Personal Credit (BPA, ≈$16,129 at 14.5%) | $16,129×0.145 | −$2,338.71 |

| Net Federal Tax | $6,518.80 | |

| Ontario Provincial Tax | ||

| 1. Tax on first $52,886 at 5.05% | $52,886×0.0505 | $2,670.74 |

| 2. Tax on remaining $7,114 at 9.15% | ($60,000−$52,886)×0.0915 | $650.93 |

| Total Gross Provincial Tax | $3,321.67 | |

| 3. Less: Ontario BPA Credit (≈$12,747 at 5.05%) | $12,747×0.0505 | −$643.72 |

| Net Ontario Provincial Tax | $2,677.95 | |

| TOTAL ESTIMATED INCOME TAX | (Federal + Provincial) | $9,196.75 |

This simplified example for taxation in Ontario excludes the Ontario Health Premium, provincial surtaxes, and other tax credits/deductions to provide a clear illustration of the progressive tax bracket method.

It is for illustrative purpose.

It is for illustrative purpose.

How Are Bonuses Taxed in Ontario

From a tax-rate perspective, a bonus is treated just like your regular salary or wages. It is not subject to a separate “bonus tax”. However, the lump-sum nature of a bonus often results in a higher amount of tax being withheld from the payment, which can make it seem like the bonus is taxed at a much higher rate.

Here is a breakdown of bonus Taxation in Ontario:

- Taxable Income: Bonuses are considered “supplemental income” and are fully taxable. This means they are subject to the same mandatory federal and provincial deductions as your regular pay:

- Federal and Provincial Income Tax

- Canada Pension Plan (CPP) contributions (up to the annual maximum)

- Employment Insurance (EI) premiums (up to the annual maximum)

- Higher Tax Withholding: The main reason people perceive a high “bonus tax” is due to the payroll withholding method. When an employer issues a large, one-time bonus, the payroll system typically annualizes that amount. By treating the large one-time payment as if you received that high amount in every pay period, the system is instructed to deduct a much larger percentage of tax at the source to prevent you from owing a large sum when you file your annual tax return.

- Marginal Tax Brackets: Since a bonus is added to your total annual income, it may push a portion of your overall earnings into a higher marginal tax bracket. This is another reason why you see a smaller net amount after deductions on your bonus paycheck. This phenomenon, however, applies to all income that exceeds a tax bracket threshold, not just bonuses.

- Final Tax Calculation: Ultimately, the actual tax you pay on the bonus is calculated when you file your annual income tax return. Any over-withholding due to the lump-sum payment will be returned to you as part of a tax refund. For more specific details on income Taxation in Ontario, including provincial tax rates, you can refer to the Canada Revenue Agency (CRA) guidelines. Understanding your total annual income is key to accurately predicting the full impact of Taxation in Ontario on your net bonus amount.

How Much Are Bonuses Taxed In Ontario

In Ontario, bonuses are not taxed separately but are added to your regular income and taxed according to the marginal tax brackets for federal and provincial taxes. Because a bonus can push you into a higher tax bracket. It might appear to be taxed at a higher rate than your regular pay.

The total amount of your bonus, along with any other income determine the rate of taxation in Ontario.

Here’s a breakdown of how much are bonuses taxed in Ontario:

Combined with Regular Income: A bonus is considered supplemental income and is combined with your regular salary. The total amount is then subject to both federal and provincial income tax.

Marginal Tax Rates: Canada uses a progressive or “marginal” tax system. This means different portions of your income are taxed at increasing rates based on the federal and provincial brackets. The bonus is added on top of your existing income, and the portion that falls into a higher tax bracket will be taxed at that higher rate.

Mandatory Deductions: In addition to income tax, bonuses are subject to mandatory deductions for the Canada Pension Plan (CPP) and Employment Insurance (EI), just like your regular salary. An exception applies if you have already reached the maximum annual contributions for these programs.

Example of bonus taxation

To explain how much are bonuses taxed in Ontario, consider the following example for the 2024 tax year:

Scenario: A person in Ontario earns a base salary of $100,000 and receives an $8,000 bonus.

Tax on salary: For a $100,000 salary, the estimated combined federal and provincial tax liability is $21,031.

Tax on combined income: By adding the $8,000 bonus, the new total income is $108,000. The estimated combined tax liability on this amount is $23,652.

Bonus tax calculation: The tax paid on the bonus alone is the difference between these two tax amounts: $23,652 – $21,031 = $2,621.

Effective tax rate on bonus: This means the effective tax rate on the $8,000 bonus is about 32.7% ($2,621 / $8,000).

This example highlights how a bonus can be taxed at a higher marginal rate than your average tax rate, even though the same rules for Taxation in Ontario apply to all forms of employment income. Understanding the impact of the bonus on your tax bracket is key to understanding the total Taxation in Ontario on your earnings.

Conclusion

Understanding taxation in Ontario is essential for both individuals and incorporated business to stay compliant and make informed financial decisions. Whether it’s knowing your tax filing deadlines, understanding how bonuses are taxed, or managing corporate tax obligations, being proactive helps you avoid penalties and optimize your financial outcomes. Ontario’s dual tax system may seem complex, but with proper planning and guidance, you can navigate it efficiently and even identify opportunities for savings.

Bizincs specialize in helping incorporated businesses simplify their tax filing, bookkeeping, and compliance processes. Our experts ensure your business stays compliant while maximizing deductions and minimizing stress.

Let Bizincs handle your taxes, so you can focus on growing your business.